what will happen to bitcoin after the october 25 fork

Bitcoin Gold (BTG/Bgold) is an upcoming hard fork of the Bitcoin blockchain that's scheduled to occur on October 25 . Bgold has nix to do with the yellow metal, so it shouldn't be confused with BitGold, the gold investment and payments firm. Bgold is as unrelatedf to both the previous difficult fork, Bitcoin Greenbacks (BCH/Bcash), which occurred on Baronial 1 , and the upcoming SegWit2x (S2X/Bizcoin) hard fork, which is scheduled for mid-November.

Why Bitcoin Golden?

Bitcoin Gold will change Bitcoin'due south proof-of-work algorithm from SHA-256, which is currently dominated mostly past Chinese ASIC miners, to the Equihash algorithm. Equihash is likewise employed by the zCash (Classic), Zencash, and Hush cryptocurrencies. Equihash is mostly mined by graphics cards (GPUs).

Co-ordinate to the Bgold pitch, returning Bitcoin mining to dwelling users will bring forth greater decentralization. However, massive Russian and Japanese Bitcoin mining operations have been planned for 2018, and then it seems that Bitcoin'southward mining centralization problem is slowly resolving itself.

The man backside Bgold, Jack Liao, is also the CEO of LightningASIC, a Hong Kong–based company that mines mostly Litecoin and produces cryptocurrency hardware. It's surely no coincidence that LightningASIC produces a multi-GPU mining unit of measurement, of which it currently holds 913 units in stock. Should Bgold succeed in taking market share abroad from Bitcoin, LightningASIC would benefit profoundly from both mining the new altcoin and selling miners for it.

Considering the Bcash and Segwit2x forks are just as transparently motivated past financial cocky-interest, it's hard to single out LightningASIC for its deportment. Were Bitcoiners not compensated with gratuitous altcoins past these spin-off forks, the defoliation and disruption they acquired would be intolerable.

How to Safely Merits Bitcoin Aureate

Any bitcoins (BTC) held in your Bitcoin wallet at the time the fork occurs will grant you an equal amount of BTG. This applies just if you lot have access to the private keys of your wallet, so no exchange wallets apply.

Although the fork will occur on October 25 , exchanges are likely to only open Bgold for trading one week afterward on November 1. This allows time for technical issues to be resolved by all participants.

Correct now, no clear instructions are bachelor for how to split up your BTC from your BTG. Exchanges and software/hardware wallets are still deciding on whether they'll support this fork.

If you participated in the Bitcoin Cash split, the procedure will be similar—though likely smoother, as exchanges and wallets have had practise and more preparation time. As ever, the most important thing to do is safeguard your Bitcoin private keys , equally BTC'due south value is far higher than BTG's.

Warning: Beware of scammers who promise to give you BTG early if you share your Bitcoin private key with them. At to the lowest degree i such scam site is currently in operation. Sharing the individual key of your Bitcoin wallet is sharing full control of any and all bitcoins therein. Beware!

Bitcoin Gilt: Hold or Sell?

When guessing at the time to come price of Bgold, the closest example to follow is Bcash. It's reasonable to expect Bgold to see a far lower launch price than Bcash achieved. Bgold enjoys far less support from miners, companies, and what might be termed the "anti-Core customs."

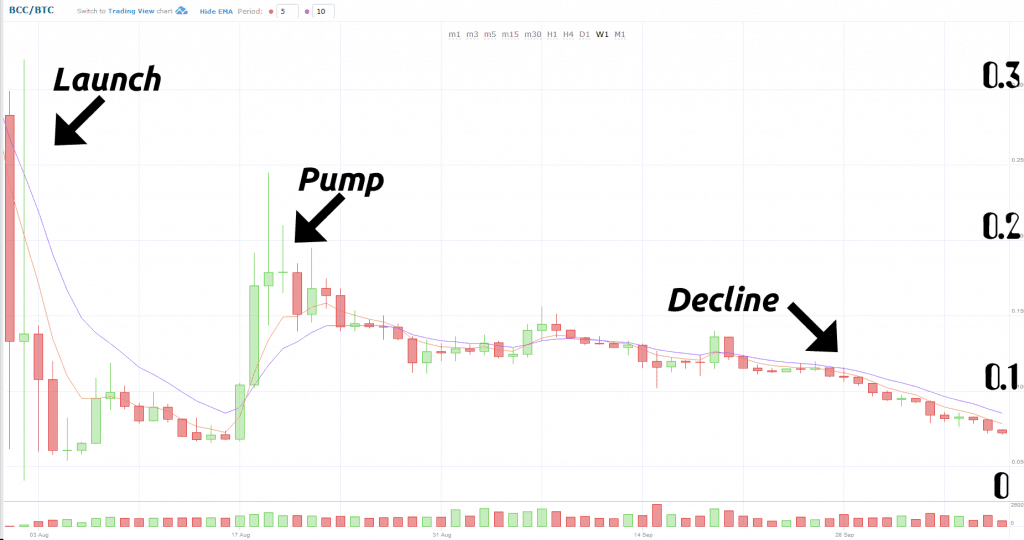

My personal expectation is that Bgold will initially trade at ~10% of Bitcoin'south value at most, probably closer to 5%. I expect high volatility on November ane when it launches on exchanges, followed by a sharp sell-off, subsequent pumps, and (depending on how Bgold develops) a steady decline. In other words, we'll see a echo of the Bcash pattern but at lower cost levels.

Bcash priced in Bitcoin on the HitBTC exchange, August ane to October 9, 2017

Reasons for Optimism

The Bgold team appears to be more technically competent than Bcash's devs. Bgold's GitHub repository appears more active than Bcash's, for example. Unlike Bcash's website, Bgold'due south isn't running on Wix, the noob-friendly website builder.

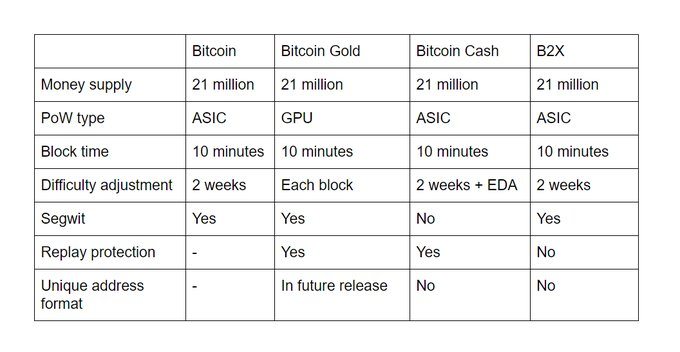

Consider the technical differences among Bitcoin and the various pretenders to its crown:

Whereas Bcash has deliberately rejected Bitcoin'south SegWit upgrade, Bgold has embraced it. Thus, Bgold may copy forthcoming Bitcoin improvements, such as Lightning Networks.

It appears that Bgold has plans to change address formatting too—a welcome modify made to prevent the accidental sending of BTC to fork-coin addresses.

Farther, Bcash's Emergent Difficulty Algorithm (EDA) has produced erratic block times that are either too tiresome or besides fast. Bgold'south per-block difficulty adjustment volition likely encounter difficulties of its ain.

These technical considerations lead me to believe that Bgold has a amend chance at long-term sustainability than Bcash. Because of the additional attractive prospect of dwelling mining Bitcoin, Bgold may somewhen absorb much of Bcash's value. However, every bit a mere clone, information technology seems doubtful that it'll have much affect on Bitcoin itself.

Reasons for Pessimism

Bgold was initially announced equally an ICO, although these early announcements have since been (unsuccessfully) scrubbed from the net. To put it mildly, it seems that the BTG plan has undergone multiple revisions.

Serious questions remain every bit to whether LightningASIC and its partners will exist mining BTG between the fork and commutation list dates. This kind of midstream pre-mine would ship such potent scam signals that LightningASIC would exist foolish to attempt it.

Another potential problem is that Bgold and SegWit2x haven't notwithstanding implemented replay protection. Unless this feature is added, in sending BTG, a user might inadvertently send BTC too, which could be a costly fault.

Update: Bitgold'due south site states that Replay protection is added.

Warning : avoid trading BTG (and S2X) until replay protection is in place!

Some other compelling reason to be bearish on Bgold is that in that location's simply no real need for information technology. Were BTG to launch as only another Equihash coin without the benefit of Bitcoin's name and transactional history, information technology'd go largely unnoticed. The only reason Bgold is interesting is that information technology'll exist freely distributed to Bitcoin holders. If the majority of Bitcoin holders are hostile to it, it'll tank.

For further cautions regarding Bitcoin Gold, bank check out this Reddit thread. While the thread is probably too harsh, I concur that buying Bgold is risky and all-time avoided.

To my mind, the simply question is how much Bgold to dump and when. Holding a pocket-size pct (maybe v%–25%) long term, as a gamble on time to come upside, doesn't seem entirely unreasonable.

Here's my Bgold trading plan

The post-obit is my ain personal have on Bgold and should not exist considered as investment advice.

While I dumped all my Bcash as shortly equally possible, I'll probably adopt a more patient strategy with Bgold. With Bcash, I had the advantage of being able to sell before almost other market participants. This is unlikely to be the case with Bgold. I await a big rush to sell when it goes alive.

Unless Bgold sinks without a trace upon its launch, Bcash history suggests that it's better to wait for a afterward pump to sell. If a futures market develops for BTG—similar to Bitfinex'southward BT1 and BT2 tokens for Bitcoin and SegWit2x—it will greatly aid the decision on how much Bgold (if whatsoever) to sell when it launches. Withal, it seems like about exchanges are ignoring Bgold at this time, then a futures market probably won't announced.

In Determination, Hither Are three Things to Do to Survive Any Difficult Fork:

- Make sure your Bitcoins are on a wallet that you control the individual central to (come across a full list of wallets here). Some examples are Electreum, any hardware wallet (Ledger, Trezor, etc.), and Exodus.

- Avoid transactions before long after the fork.

- After you get the all clear, access your new coins. At this point, you lot can motility them to a designated wallet or sell them.

Follow Bitcoin Gold developments on the official Bitcoin Gold Twitter business relationship.

What are your thoughts nigh Bitcoin Gilt? I would dearest to hear them in the comment section below.

We hate spam as much as you do. You tin unsubscribe with one click.

Source: https://99bitcoins.com/the-bitcoin-gold-hard-fork-explained-coming-october-25th/

0 Response to "what will happen to bitcoin after the october 25 fork"

Post a Comment